Despite Optimism, Community Bankers Aren’t Fully Convinced of an Economic Soft Landing

By Thomas F. Siems, Ph.D., CSBS Chief Economist

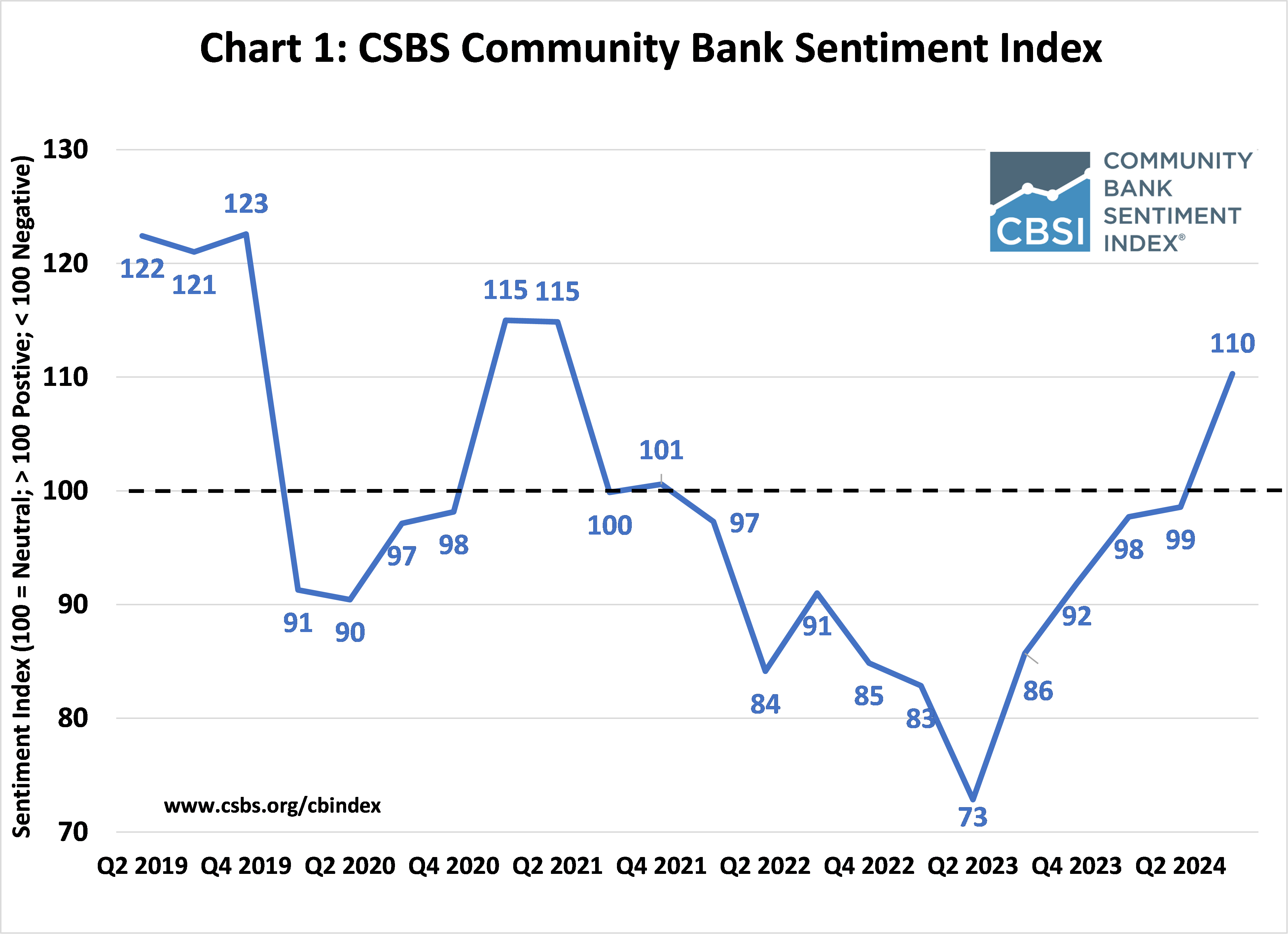

After nearly three years, community banker sentiment is signaling an encouraging outlook. The CSBS third quarter 2024 Community Bank Sentiment Index (CBSI) indicates that community bankers are the most optimistic they have been since mid-2021, although some concerns persist.

The Federal Reserve’s aggressive monetary policy tightening in 2022 and 2023, and the long pause in higher interest rates appears to have come to an end with the 50-basis point cut in the Fed funds rate in September. As a result, expectations for higher future bank profitability and franchise values are at their highest levels in five years. However, there are lingering concerns about future business conditions and the possibility of an economic soft landing to avoid a recession.

As shown in Chart 1, at 110, the CBSI burst into positive sentiment territory after being below the neutral level of 100 since the end of 2021. The overall index has advanced for five consecutive quarters for the first time in the five-year history of the survey. The CBSI is up 24 points since last year and 37 points from its nadir of 73 in mid-2023, driven higher mostly by optimism in three components: improved future profitability, expectations for better outcomes from monetary policy, and higher anticipated franchise values. Yet, even with these improvements, the most recent survey still shows some ongoing concerns about future business conditions and regulatory burden.

The Good News

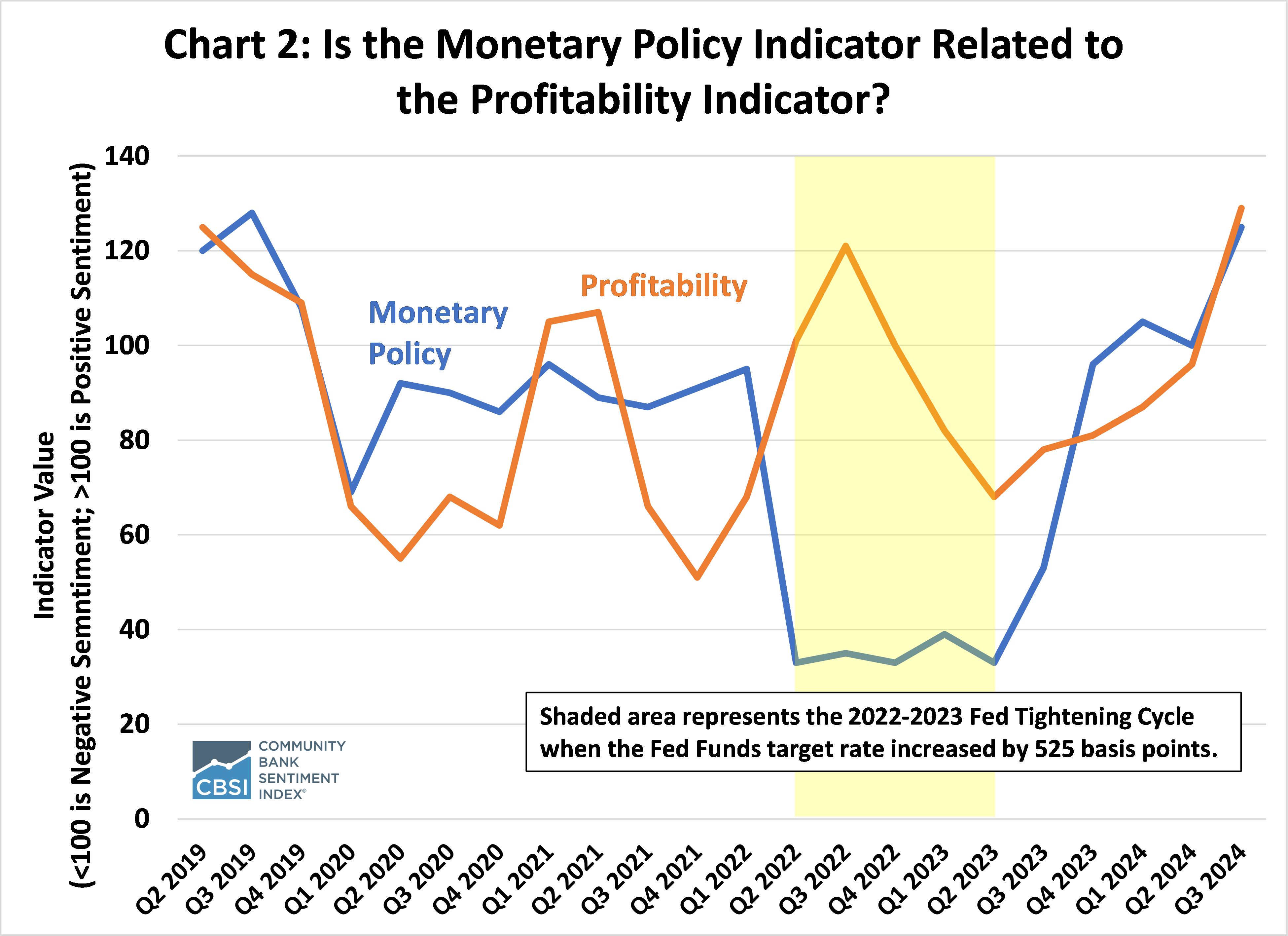

In the third quarter 2024 CBSI survey, the future profitability component, at 129, is at its highest level since the survey began in 2019, as shown in Chart 2. The profitability indicator has improved for five consecutive quarters, climbing 61 points since mid-2023. Moreover, the monetary policy component, at 128, is at its second highest level and has also increased five consecutive quarters from its all-time low of 33 in mid-2023. Indeed, the last time both indicators were above 100 at the same time was in 2019.

So, are expectations that monetary policy decisions improve a community banker’s economic outlook related to higher future bank profitability? Except for the period when the Fed significantly increased the Fed funds rate to combat rising inflation (see the yellow shaded area in Chart 2), it appears that the two indicators are related.

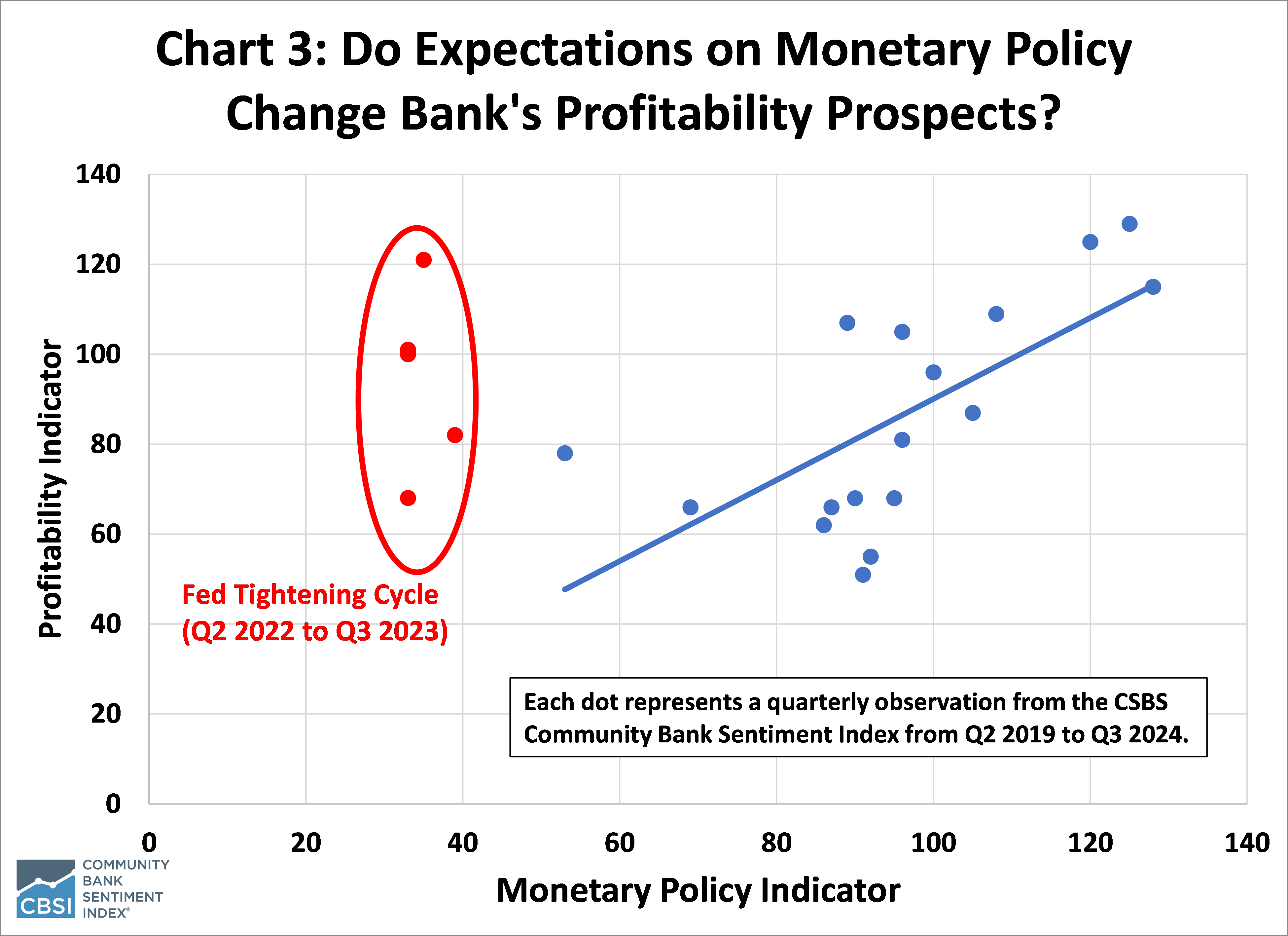

Chart 3 shows a scatter plot of these two indicators where each dot represents a quarterly observation from the CBSI survey since its origination in 2019. The five red dots circled on the chart indicate the time periods during the Fed tightening cycle. The blue line suggests a fairly tight relationship between the monetary policy and profitability indicators for the other time periods.

It is worth noting some possible reasons why the observations during the Fed’s tightening cycle do not seem to follow the pattern of the other data points. The Fed’s tightening in 2022-2023, in response to significantly accelerating inflation, substantially raised interest rates and inverted the yield curve. Historically, aggressive monetary policy tightening slows economic growth as higher interest rates make it more expensive to borrow for businesses and consumers. Making personal and business loans, home mortgages, and credit card borrowing more expensive discourages overall borrowing and spending. As spending and investment slackens, economic growth generally decelerates along with inflation rates, and then labor markets lose speed because of reduced spending and slower economic growth.

So, it is not surprising that bankers expected a worsening economic outlook during the Fed’s tightening cycle. What’s probably more surprising are the three observations when bankers continued to expect higher profitability, all of which were recorded during the final three quarters of 2022. It could be that community bankers welcomed the initial interest rate increases to boost their net interest margins by lifting off from the historically low levels. Or, it could be that community bankers maintained strong profitability during this period because of the government’s Paycheck Protection Program following the pandemic/lockdowns. Or, it could be that profitability concerns worsened only when the yield curve (10-year Treasury rate minus the Fed funds rate) finally inverted in late 2022.

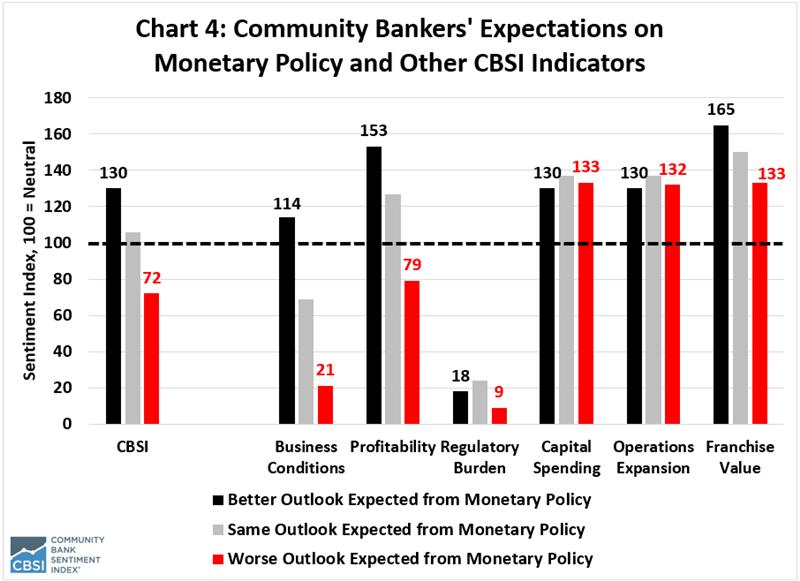

To further examine the relationship between expected monetary policy impacts on the economy and community bank profitability prospects, I took a deeper dive into the survey responses using the interactive dashboard on the CBSI webpage to examine how community banker sentiment differs for those bankers currently expecting the Federal Reserve’s monetary policy decisions to improve the market outlook from those you say it will worsen. Forty-four percent of community bank respondents expect monetary policy decisions to improve their economic outlook, 32% said their outlook would remain the same, 19% indicated it would worsen, while 5% were unsure.

As shown in Chart 4, community bankers expecting monetary policy decisions to improve their outlook (black bars) have an overall positive sentiment of 130, a value that is 20 points higher than the overall reading of 110. These bankers also expect higher profitability (153).

The Bad News

In contrast, community bankers expecting a worsening economic outlook from monetary policy decisions (red bars) have an overall pessimistic sentiment of 72, which is 38 points below the overall index. Moreover, these bankers have below neutral sentiment of 79 for future profitability, 50 points below the current reading of 129 and 74 points below the value for bankers expecting a better outlook from Fed policy decisions.

Perhaps the greatest concern from this survey is the large difference between the two groups of bankers on their outlook for business conditions over the next 12 months. Overall, the business conditions indicator, at 80, is still signaling a worsening economic outlook. Indeed, in a special question, 79% of community bankers say that the economy is at the start of, or already in, a recession.

But for bankers expecting monetary policy decisions to worsen economic activity, the future business conditions indicator is 21, fully 59 points below the overall reading of 80 and 93 points below the value of 114 for bankers expecting monetary policy decisions to improve their market outlook.

The Takeaway

In conclusion, it appears that bankers are more confident in the Fed’s monetary policy decisions as they attempt to strike the right balance between their dual mandate of price stability (2% inflation rate target) and full employment. So far, economic growth has surpassed most economists’ forecasts. But according to the most recent CBSI survey, the jury is still out on whether the economy will have a soft landing and avoid a recession.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter