Community Bankers on Economy: Sunshine with Some Dark Clouds Emerging

Washington, D.C. - Community bankers report an overall positive economic outlook for a third consecutive quarter, but their confidence in future business conditions is fading, according to the first quarter Community Bank Sentiment Index (CBSI) results.

Washington, D.C. - Community bankers report an overall positive economic outlook for a third consecutive quarter, but their confidence in future business conditions is fading, according to the first quarter Community Bank Sentiment Index (CBSI) results.

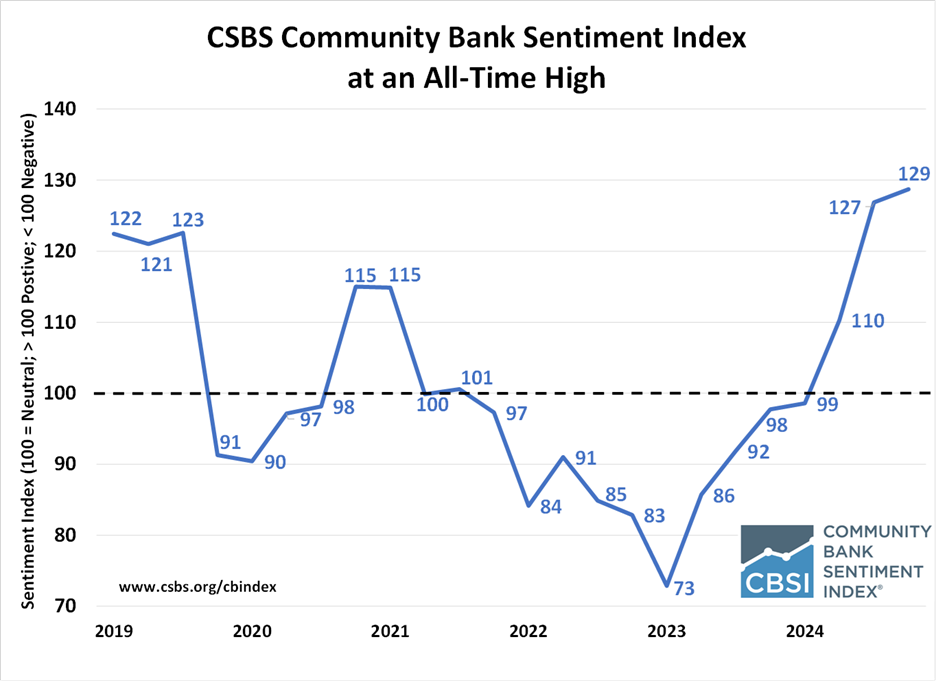

The Conference of State Bank Supervisors (CSBS) polls community banks nationwide quarterly to gauge their sentiment in seven economic components. A score of 100 points is neutral. Anything above 100 is a positive outlook, and anything below is considered negative. CSBS collected responses throughout the month of March from 282 banks in 44 states for the 2025 first quarter survey, prior to the tariff implementation.

The CBSI edged two points higher to 129 with improvements in four components compared to the prior quarter. The overall index was driven higher mostly on expectations of a lighter regulatory environment, higher expected profitability, and higher franchise values.

Most of the gains were offset by a deterioration in business condition expectations and a pullback in optimism about how future monetary policy decisions might affect the economy.

“Heightened economic uncertainty from evolving policy discussions in Congress and with the new Administration have clouded the 2025 economic outlook,” said CSBS Chief Economist Tom Siems. “At the same time, overall community banker sentiment is being buoyed by expectations that the regulatory environment will be less burdensome in the future, and expectations for greater profitability remain high. The result is a CSBI that is essentially unchanged from last quarter.”

This quarter’s CBSI marks a record high since the survey began in 2019. At 130, the regulatory burden component is above 100 for the first time in the survey’s history and had the greatest quarterly improvement, gaining 30 points from the fourth quarter survey. The profitability and franchise value components both reached their highest points ever at 152 and 162 respectively.

The business conditions indicator, however, dropped 31 points to 86 in the first quarter, and is the only component below 100. The monetary policy component also dropped to 106 but remains in positive territory for the fifth straight quarter.

In a special question, 59% of community bankers believe the U.S. economy is at the start of, or already in, a recession, up from 41% last quarter. Many community bankers mentioned the economic uncertainty from the potential impacts from tariffs would restrain economic growth until there is greater clarity.

Contact: Susanna Barnett, 202-680-3143, [email protected]

X: @CSBSNews

The Conference of State Bank Supervisors (CSBS) is the national organization of financial regulators from all 50 states, American Samoa, District of Columbia, Guam, Puerto Rico, and U.S. Virgin Islands. State regulators supervise 79% of all U.S. banks and a variety of non-depository financial services. CSBS, on behalf of state regulators, also operates the Nationwide Multistate Licensing System to license and register non-depository financial service providers in the mortgage, money services businesses, consumer finance and debt industries.

- Blog post

Can Community Banker Optimism and Greater Economic Uncertainty Coexist?

Apr 8, 2025

- Blog post

Why Are Community Bankers More Optimistic?

Jan 21, 2025

- Press Releases

Community Banker Optimism Surges at End of Year

Jan 7, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts