Why Are Community Bankers More Optimistic?

By CSBS Chief Economist Thomas F. Siems, Ph.D.

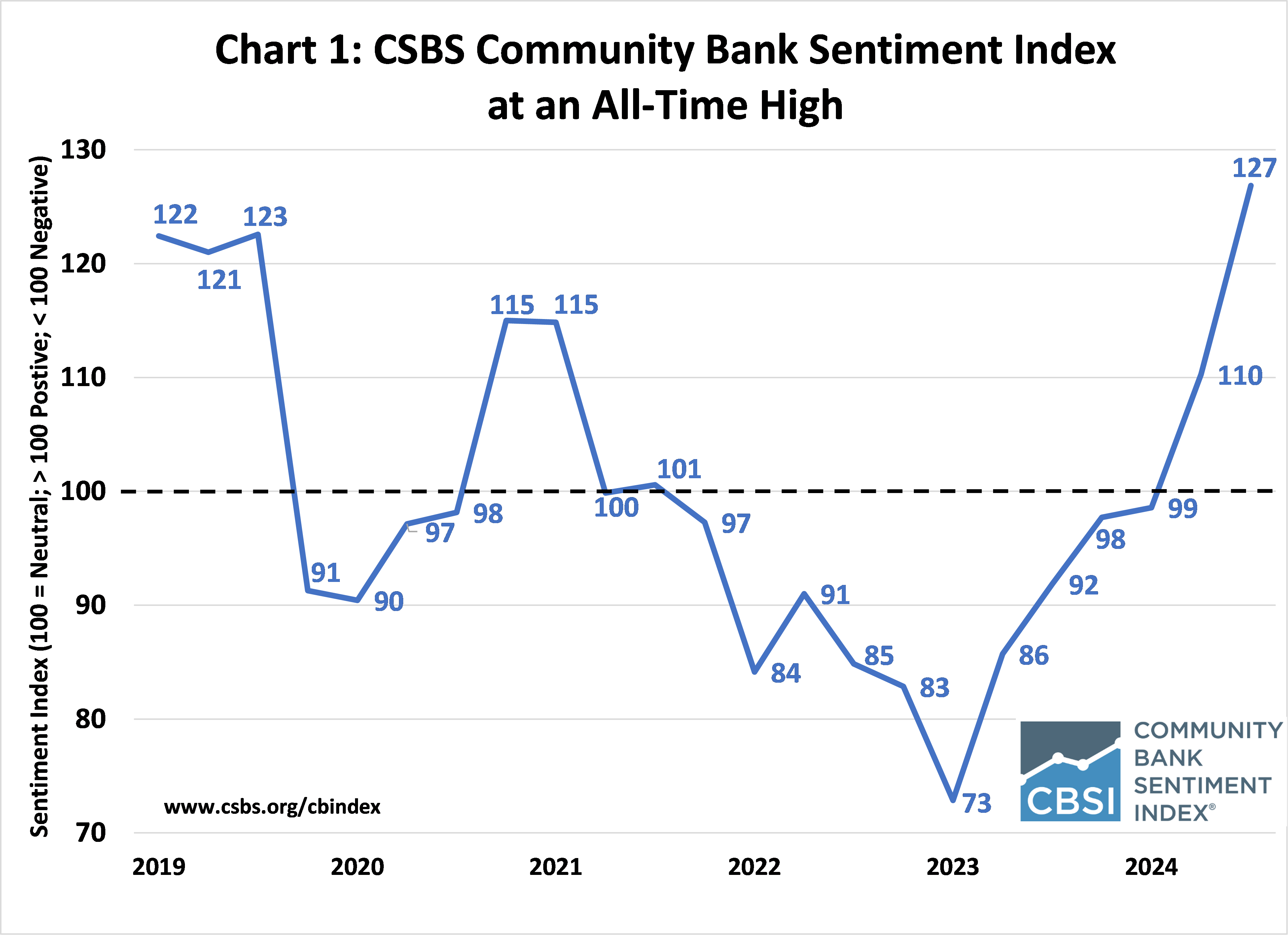

Last week, CSBS announced the results of the CSBS fourth quarter 2024 Community Bank Sentiment Index (CBSI). Driven mainly by expectations for a more-balanced regulatory environment and better future business conditions, the CBSI surged to its most optimistic reading since the survey’s debut in 2019. What caused this sudden positive outlook?

Chart 1 shows that, at 127, the CBSI is at its highest recorded level and has advanced for six consecutive quarters from its nadir of 73 in mid-2023. The index crossed the neutral level of 100 into positive sentiment territory—indicating increased optimism—just six months ago after previously signaling a pessimistic outlook with readings below 100 for 10 consecutive quarters. The CBSI is up 17 points since last quarter and up 35 points from one year ago.

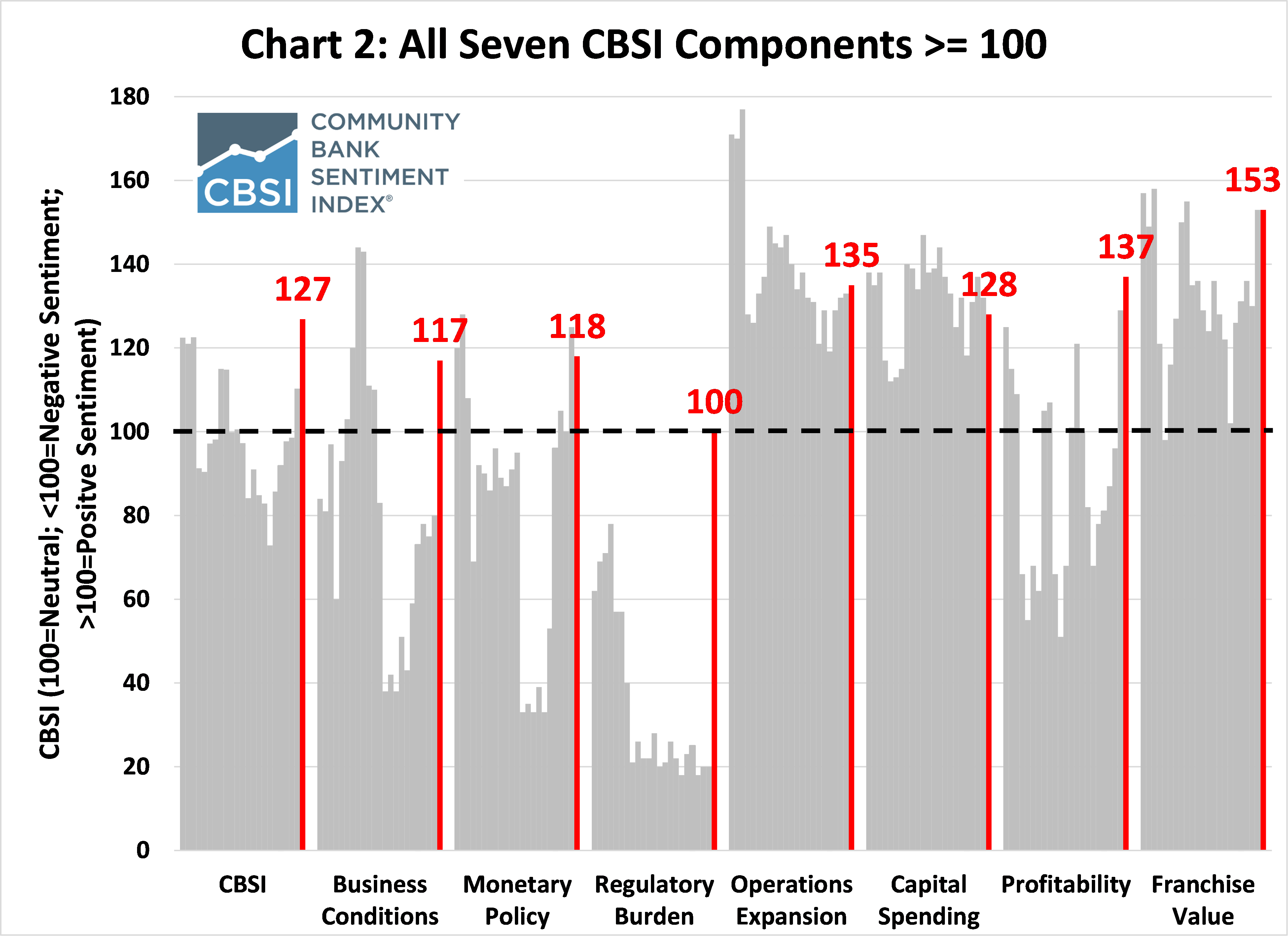

Chart 2 shows that all seven components that comprise the index are above the neutral level of 100 for the first time in the index’s history. Perhaps the biggest surprise is that the regulatory burden component increased dramatically from 20 last quarter to 100 this quarter. In fact, the regulatory burden indicator is currently 22 points higher than its previous peak of 78, reached in early 2020.

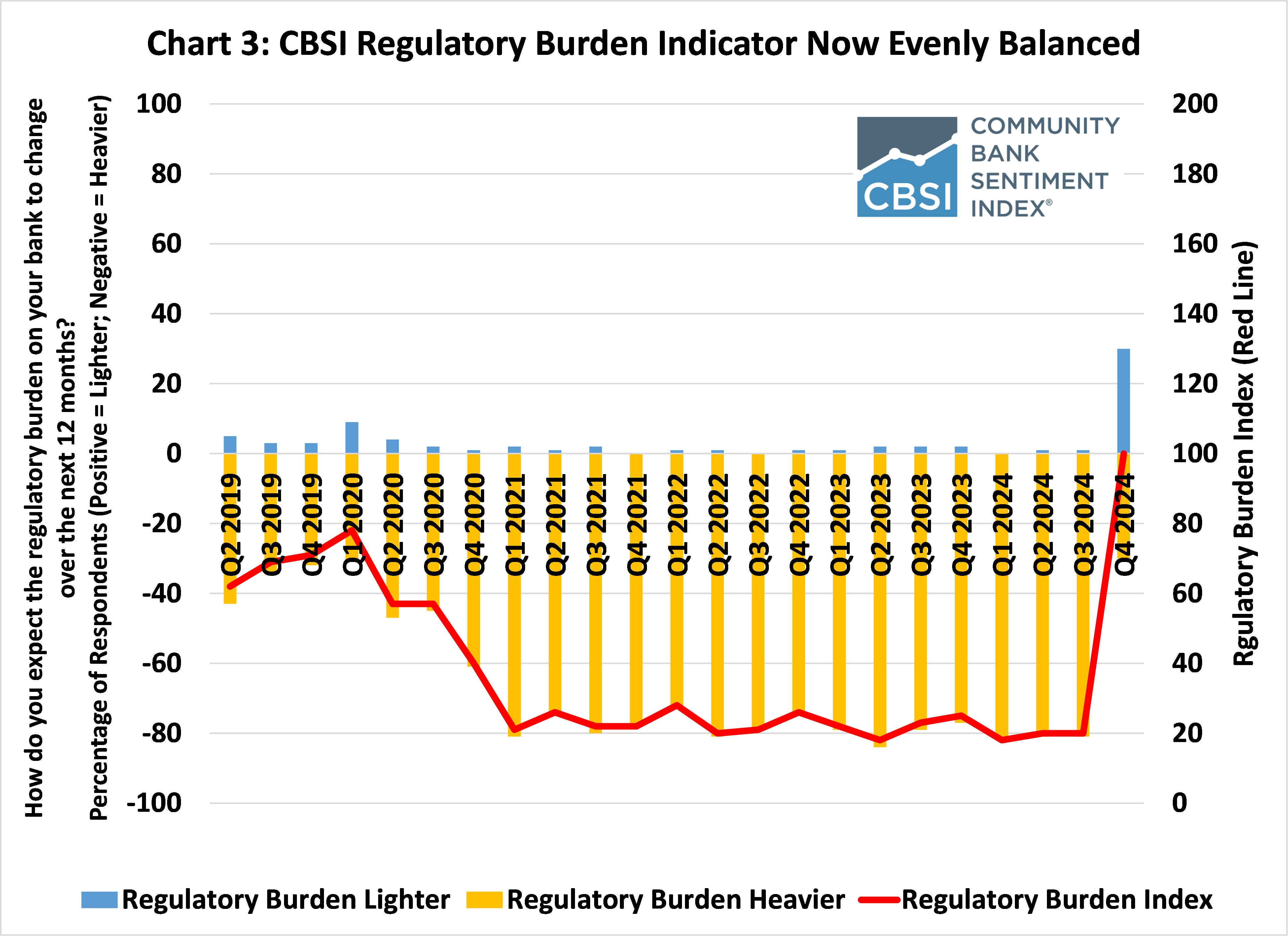

Did the 2024 U.S. presidential election have anything to do with this extraordinary jump? It certainly appears so.

As shown in Chart 3, the average reading for the regulatory burden component over the past four years was 23, with an average 78% of respondents expecting a heavier regulatory burden and no more than 2% during any quarterly survey expecting a lighter regulatory burden. But now, in the most recent CBSI survey, the responses to this survey question are evenly balanced: 29% of community bankers expect a lighter regulatory burden in the coming year, 29% expect a heavier burden, nearly 38% expect it to remain the same, and 4% say they are unsure.

Using the interactive dashboard on the CBSI webpage, I examined how community banker sentiment differs for those bankers expecting a lighter regulatory burden from those expecting the regulatory burden to be heavier. Not surprisingly, community bankers expecting a less burdensome regulatory environment are far more optimistic based on their aggregated sentiment, with an overall index reading of 146 versus a sentiment score of 106 for those bankers expecting a more burdensome regulatory environment.

Moreover, in the open-ended comments, several community bankers said their outlook on bank regulation improved following the 2024 U.S. presidential election, but many also noted that any expected relief will take time. Here are some selected comments:

- "I am hopeful that bank regulations will decrease for small community banks, but that has been my hope for the past 30 years and it has done nothing but get worse and harder to operate."

- We anticipate a turn in regulation with the new administration, but it will take some time to unwind some of the regulations/actions from 2024.

- "I do not believe current regulations are going away, but I am hopeful recently passed regulations and guidance will be amended in a favorable way to banks."

- I'm optimistic that banks and businesses in general will benefit from a lower regulatory burden environment over the next four years."

- "As per the amount of government regulation I expect that we will see this flatten and potentially decrease. This will positively impact many businesses and industries in a positive, more efficient direction."

While community bankers’ views on the costs and hassles of dealing with government regulations have been a main source of frustration for them for many years, it is generally believed that smaller institutions have a bigger compliance burden than do larger and nonbank financial institutions. How much greater is this regulatory burden? This will be the subject of a focused research effort at CSBS this year as we examine the ongoing consolidation of the U.S. banking system and the driving forces behind smaller banks potentially becoming too small to succeed.

In conclusion, in our survey following the outcome of the 2024 U.S. presidential election, community banker sentiment climbed to its highest recorded reading since the index began in 2019. Additionally, all seven indicators that comprise the index are at, or above, the neutral level of 100 for the first time in the series’ history. But the most recent gains in the overall index have been driven mainly by massive improvements in two components: regulatory burden and business conditions. Presently, community bankers expect a more-balanced regulatory environment and are optimistic that business conditions will improve in 2025.

- Press Releases

Five Teams Move to CSBS Community Bank Case Study Competition Finals

Jun 10, 2025

- Press Releases

CSBS Community Bank Case Study Competition Moves to Round Two

Jun 3, 2025

- Press Releases

CSBS Announces 2025 Community Bank Case Study Competition Teams

May 15, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts