Can Community Banker Optimism and Greater Economic Uncertainty Coexist?

By CSBS Chief Economist Thomas F. Siems, Ph.D.

Community bankers indicated both greater optimism and more uncertainty in the CSBS first quarter 2025 survey. While optimism and uncertainty generally move in opposite directions, future expectations for three of the index’s components seem to create a thought-provoking narrative in these uncertain times.

Community bankers’ optimism stems primarily from hopes that the regulatory environment will become less burdensome and profitability will be higher; however, recent shifts in fiscal policy—including trade negotiations, tariffs, immigration reforms, federal government tax and spending cuts, and other actions—have shifted expectations for future business conditions downward and created a more uncertain economic outlook for 2025.

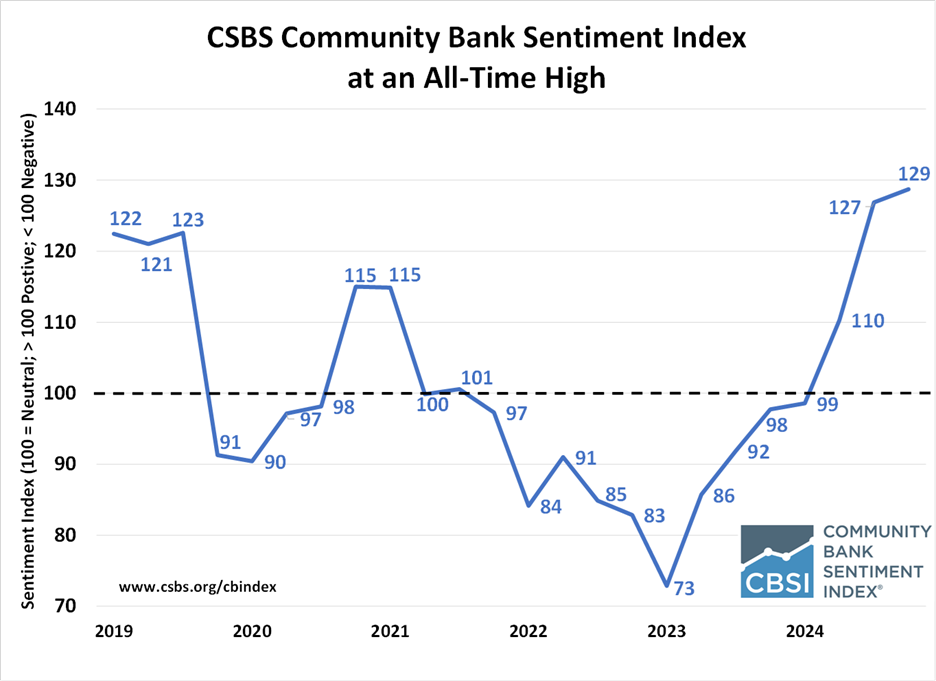

Chart 1 shows that, at 129, the CBSI edged slightly higher than its previous highest-recorded level and has now advanced for seven consecutive quarters from its nadir of 73 in mid-2023. The index crossed the neutral level of 100 into positive sentiment territory, which indicates increased optimism, six months ago after previously signaling a pessimistic outlook with readings below 100 for 10 consecutive quarters. The CBSI is up two points since last quarter and up 31 points from one year ago.

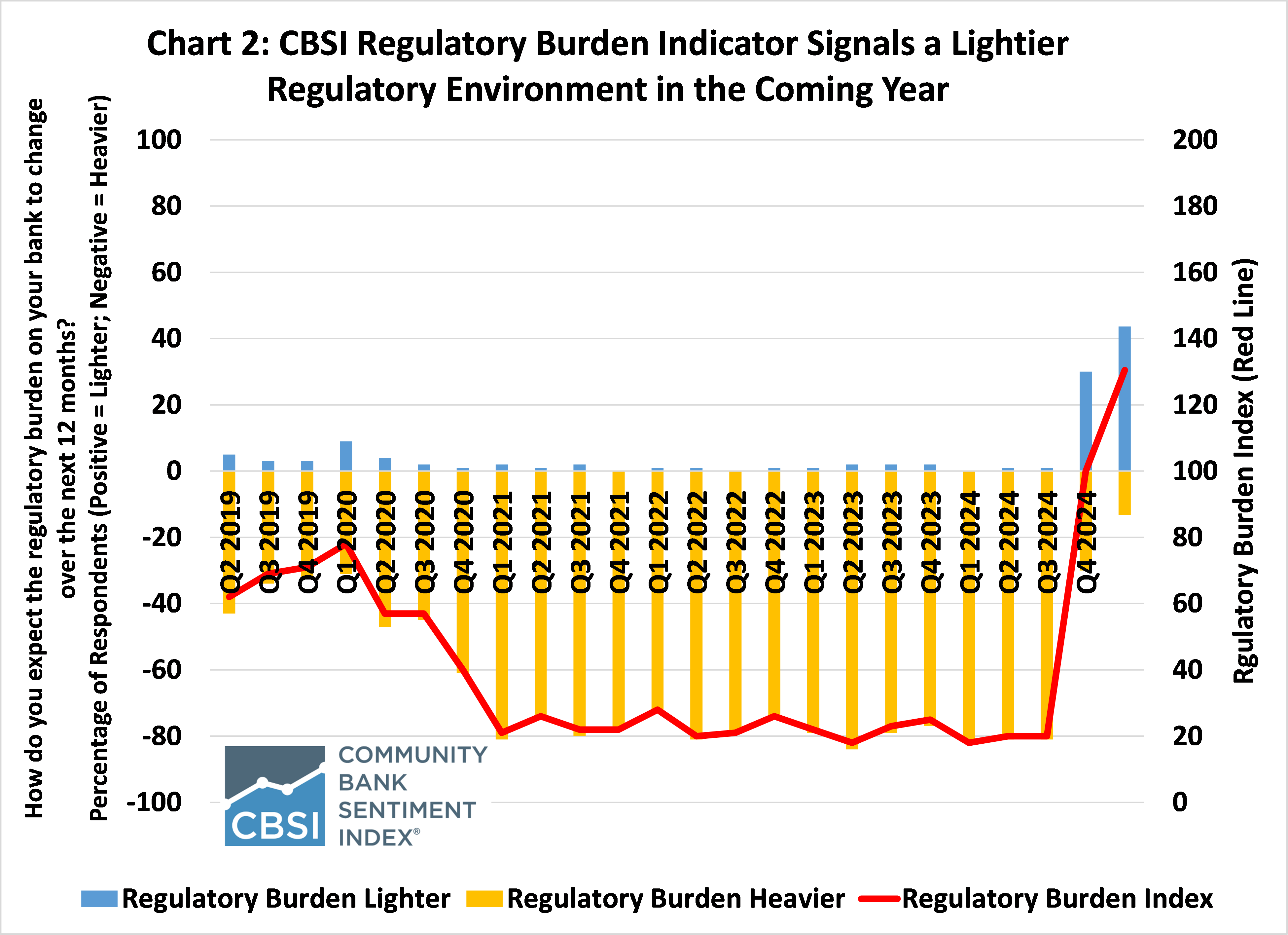

As I discussed after the fourth quarter 2024 CBSI results were released, the 2024 U.S. presidential election seems to have had a lot to do with the extraordinary jump in community banker sentiment. Chart 2 shows that the average reading for the regulatory burden component from 2021 to the third quarter of 2023 was 23, with an average 78% of respondents expecting a heavier regulatory burden, and no more than 2% during any quarterly survey expecting a lighter regulatory burden.

But over the past two CBSI surveys, the responses to this question have shifted to expectations of a lighter regulatory burden in the coming year. In the first quarter 2025 CBSI survey, nearly 44% of respondents expect a lighter regulatory burden, 13% expect a heavier burden, 39% expect it to remain the same, and 4% say they are unsure. The 112-point improvement in the regulatory burden indicator over the past year has contributed 16 additional points to the overall CBSI.

Despite this massive shift in sentiment regarding regulatory burden, the latest survey is signaling deteriorating business conditions and a thicker cloud of uncertainty.

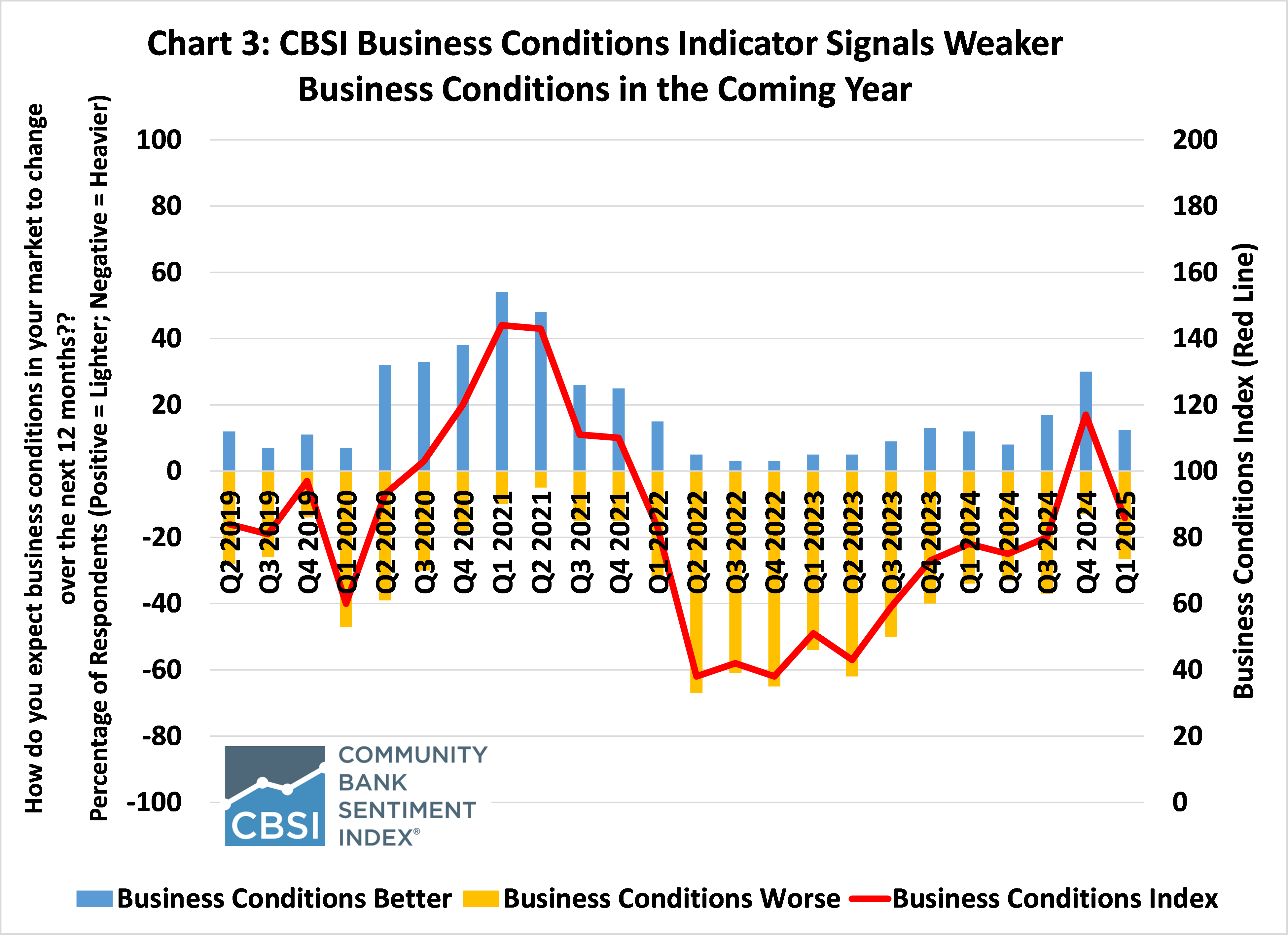

Chart 3 shows that the future business conditions indicator fell back this quarter from its temporary move into positive sentiment territory (above 100) last quarter. The business conditions indicator is currently 86, down from 117 last quarter after previously being below 83 for 11 consecutive quarters.

Moreover, this deteriorating outlook coincides with greater uncertainty, as shown in Chart 4. The uncertainty metric is computed by adding together all the “I don’t know/unsure” responses to the seven sentiment questions. At 37, the CBSI Uncertainty Index is at its highest level since the pandemic/economic lockdowns during mid-2020. Most of the recent uncertainty comes from opacity around future monetary policy decisions (orange segment of bar) and vagueness on how business conditions (blue segment) will eventually unfold.

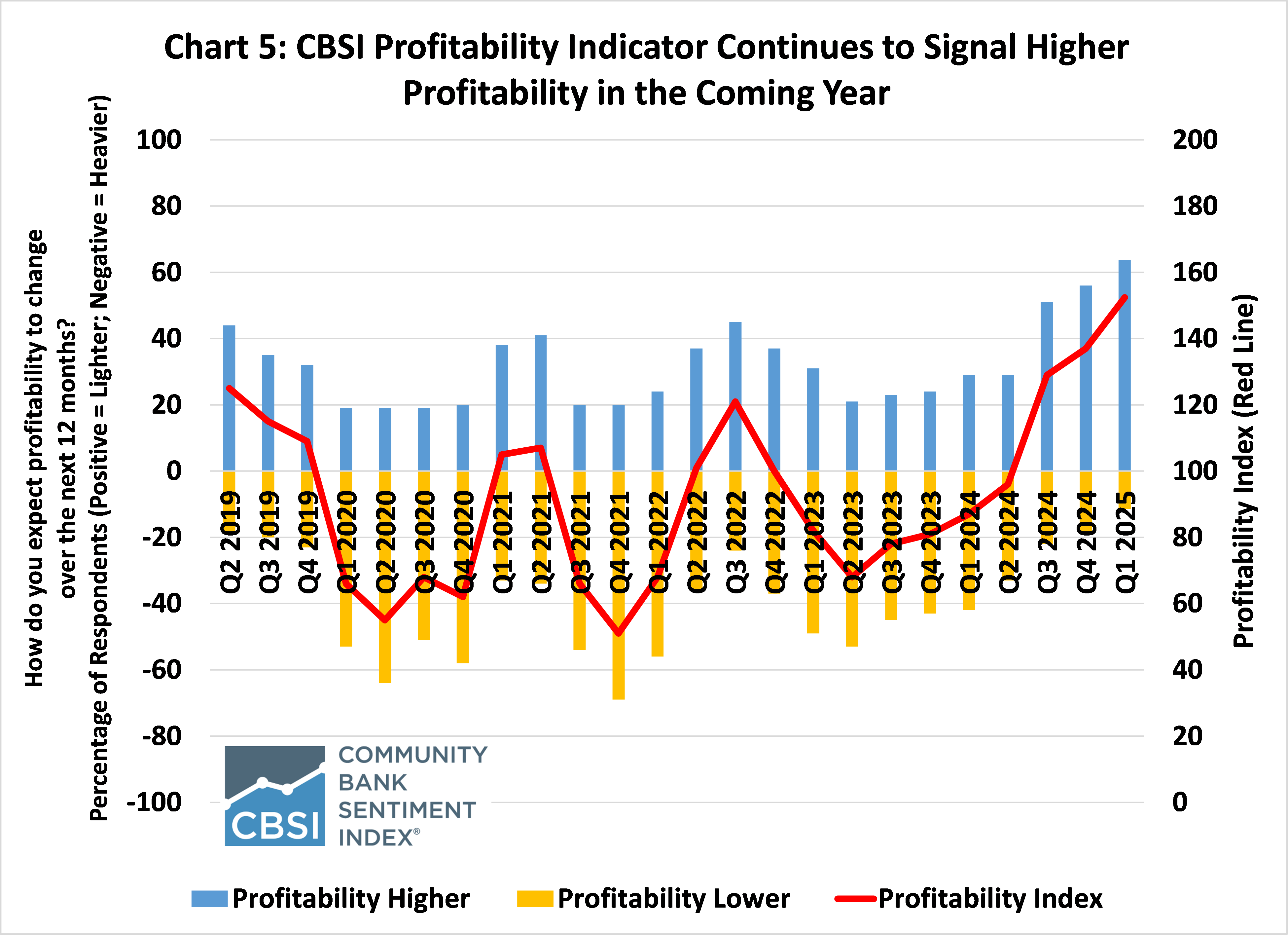

Yet, at the same time, expectations for higher profitability moved to their highest level since the survey premiered in 2019, as shown in Chart 5. The declining economic outlook coupled with greater uncertainty seems incongruous with rising profitability expectations. Indeed, the interactive dashboard on the CBSI webpage shows that 64% of respondents to the survey expect higher profitability, while 23% say it will remain the same, and 11% say it will decline. All three groups expect business conditions to worsen with business conditions sentiment values of 91 for the higher profitability group, 82 for those who say profitability will remain the same, and 69 for the lower profitability respondents.

How can this be?

Well, here are some of my observations from the data and discussions with community bankers.

First, I’m engaged in ongoing research expected to be completed latethis year that shows statistically significant differences in regulatory compliance costs for smaller banks. The costs are disproportionately higher for smaller institutions, making it more difficult for smaller banks to compete and maintain higher profits.

However, if community bankers expect a lighter regulatory burden, they should not have to devote as many resources to compliance-related activities and can instead reallocate work to lending and other profit-making activities. One banker said, “Regulatory relief is showing tangible signs … Such will allow smaller players to compete and help us spend less money on regulatory items that we pass along to the consumer which will allow more profits to reinvest in our organization and community.”

Second, in one of the special questions in the CBSI, we ask community bankers their level of concern on a list of 15 items. Probably not surprisingly, cyberattacks and bank fraud are at the top of their list of concerns. But with respect to profitability, community bankers list “loan growth” and the “quality of loans” as tenth and eleventh on the list.

Community bankers are relationship lenders who know their customers and their local economies. Even when the CBSI survey indicated pessimism on future business conditions from 2022-2024 and the yield curve remained inverted, community banks continued to maintain profitability. One banker said, “We are optimistic about our local economy as it continues to grow. Falling mortgage rates are starting to boost housing construction and mortgage origination.”

Third, in another special question, 59% of community bankers indicate that the economy is currently in a recession or about to enter one. This is up from 41% last quarter. However, when asked where the business cycle will be a year from now, 38% believe the economy will be in a recession, and the other 62% say the economy will be in a recovery or expansion. Several bankers signaled that they expect any economic downturn to be shallow and short-lived. One banker said, “We expect a slight to moderate recession given current headwinds.”

Of course, it remains to be seen how the fog of economic uncertainty will dissipate and how long it will take to have greater clarity on the national outlook. But community bankers’ deep ties to their local customers and businesses help them gain insight into local economic conditions where they can effectively manage risk. Many community bankers specialize in serving niche markets so they are aware of risks and opportunities which can help insulate them from broader economic volatility. So, while national headlines may paint a gloomy economic picture, community banks often have a more grounded, focused perspective that often leans optimistic at the local level.

In conclusion, community banker sentiment edged slightly higher to start 2025 and reached a new record high reading since the index began in 2019. Six of the seven indicators that comprise the index are at, or above, the neutral level of 100, with future business conditions falling back into pessimistic territory. The CBSI Uncertainty Index has risen to its highest level since the pandemic/lockdowns. Even so, community bankers expect higher profitability in the coming year.

- Press Releases

Community Bankers on Economy: Sunshine with Some Dark Clouds Emerging

Apr 8, 2025

- Blog post

Why Are Community Bankers More Optimistic?

Jan 21, 2025

- Press Releases

Community Banker Optimism Surges at End of Year

Jan 7, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts