Community Bankers’ Success Hinges on Managing Growing Uncertainties

By Thomas F. Siems, Ph.D., CSBS Chief Economist

The CSBS second quarter 2024 Community Bank Sentiment Index (CBSI) indicates that community bankers are less pessimistic than they have been since the end of 2021, but some concerns persist.

The Federal Reserve’s aggressive monetary policy tightening over the past 27 months has significantly raised interest rates, resulting in greater deposit competition, a yield curve that has been inverted since late 2022, and uncertainty about where the economy goes from here. With narrower net interest margins and significant liquidity challenges, community bankers’ efforts to maintain profitability continues to pose difficulties in managing financial risks that arise due to interest rate and maturity mismatches between a bank’s assets and liabilities.

At 99, the CBSI remains faintly below the neutral level of 100 but is 26 points higher than its historic low of 73 one year ago. While community banker sentiment has not been this high since 2021, the most recent survey underscores some ongoing concerns about future business conditions, profitability, and regulatory burden.

Chart 1 shows that the CBSI has been below the neutral level of 100—which signals that community bankers have a pessimistic outlook—since the start of 2022. However, the most recent reading is the highest level in 10 quarters and has advanced for four consecutive quarters, demonstrating that community banker sentiment today is not as dismal as recorded in recent surveys.

Over the past two years, four of the seven indicators that comprise the CBSI have been main contributors in dragging the overall index below the neutral level of 100. While all these components have improved from one year ago, three of the four remain in “contraction” or “pessimism” territory below the neutral level:

- Regulatory burden improved from 18 to 20.

- Monetary policy improved from 33 to 100.

- Business conditions improved from 43 to 75.

- Profitability improved from 68 to 96.

Most notable are the improvements in the monetary policy indicator (up 67 points), the future business conditions component (up 32 points), and the profitability gauge (up 28 points).

Using the interactive dashboard on the CBSI webpage, I took a deeper dive into the survey responses to examine how community banker sentiment differs for those expecting higher profitability from those expecting lower profitability. This component was chosen because, at 96, overall sentiment for the profitability component is close to both the overall sentiment of 99 and the neutral level of 100. There is also a similar distribution of responses, with 29% of community bankers indicating higher profitability over the next year, 34% expecting lower profitability, and 35% anticipating profitability will remain the same.

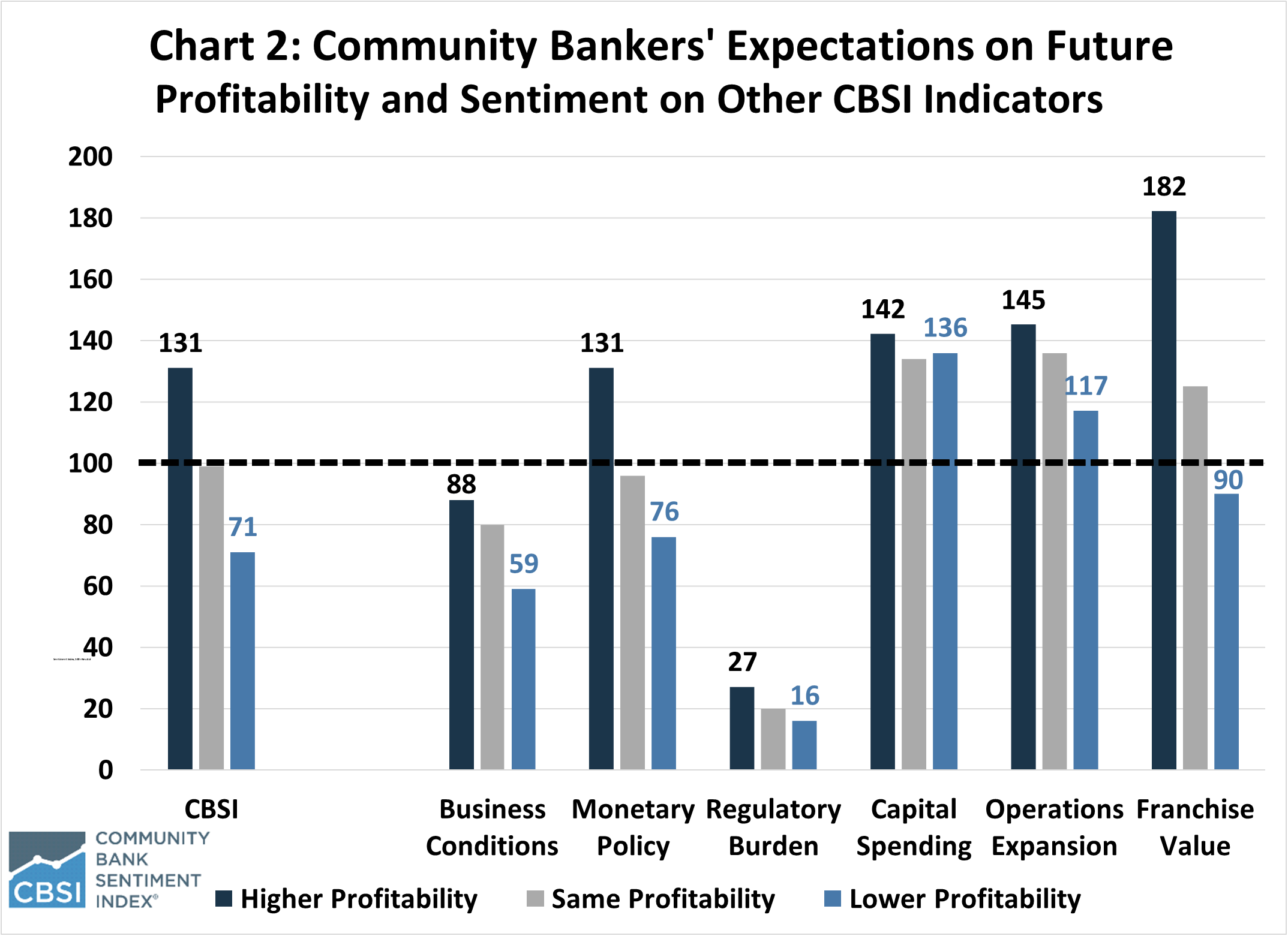

As shown in Chart 2, community bankers expecting higher future profitability (black bars) have an overall positive sentiment of 131, a value that is 32 points higher than the overall reading of 99. However, as a group, these bankers still have pessimistic sentiment regarding future business conditions (component index = 88) and regulatory burden (27). And interestingly, community bankers anticipating higher profitability are also the ones who expect a better economic outlook from monetary policy decisions (131).

In stark contrast, community bankers expecting lower future profitability (red bars) have an overall pessimistic sentiment of 71, which is 28 points below the overall index. And they have below neutral sentiment of 59 for future business conditions, 16 for regulatory burden, and 76 for monetary policy. In addition, the franchise value component among these bankers also turned pessimistic at 90.

The franchise value indicator has the largest gap (92 points) between bankers expecting higher profitability (182) from those expecting lower profitability (90). However, since future profitability is directly related to a bank’s future franchise value, this rather close relationship makes sense.

Community bankers expecting lower profitability are still bullish on capital expenditures (136) and expanding operations (117). While the values are not as high as they are for bankers anticipating higher profitability (capital expenditures at 142 and expanding operations at 145), the metrics reflect a commitment by community bankers to serve their communities with the best product and service offerings possible over the longer-term.

The other two components with large gaps between bankers expecting higher profitability from those expecting lower profitability are monetary policy (55 points) and business conditions (29 points). These gaps seem to indicate that community bankers’ profitability expectations and their overall sentiment and outlook is strongly related to their perspective on how the Federal Reserve’s monetary policies will impact future business conditions.

But there is also growing uncertainty among community bankers, particularly regarding the direction of future monetary policy. Chart 3 shows the CBSI Uncertainty Index, which is calculated by adding together the percentage of “I don’t know/unsure” responses to the seven CBSI component questions. The longer the bar the greater the level of uncertainty.

The chart shows that uncertainty rose 10 points from 19 last quarter to 29 this quarter and is currently at its highest level since the first quarter of 2022 when the Fed began raising interest rates. Moreover, monetary policy uncertainty (the orange portion of each bar) is the main contributor to overall uncertainty.

Since monetary policy operates with long and variable lags, community bankers may be concerned that the economy has not yet felt the full force of the Fed’s recent aggressive tightening cycle that raised short-term interest rates by 525 basis points in 2022 and early 2023. In open-ended responses at the end of the CBSI survey, community bankers also indicate other reasons they are more uncertain. In addition to concerns about monetary policy, community bankers mentioned political/election-year uncertainty, geopolitical risks, concerns about how to handle the growing federal debt, and regulatory burden.

Uncertainty becomes an enemy of success when it undercuts effective decision making and good risk management practices. Of course, community bankers and their customers must deal with some uncertainty, but how they manage to sustain profitability and grow their franchise value in a higher interest rate environment with an inverted yield curve may hold the keys to their continued success.

To learn more about the most recent CBSI, listen to CSBS’s Simply Stated Podcast interview with Chief Economist Tom Siems.

- Press Releases

Community Banker Optimism Reaches New High

Oct 2, 2025

- Blog post

Letter of Appreciation to Jonathan A. Scott

Aug 20, 2025

- Press Releases

Community Bankers Maintain Positive Economic Outlook

Jul 8, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter