Community Banks’ Product Pricing Influence in Local Markets

By Temple University Professor of Finance Jonathan A. Scott and CSBS Chief Economist Thomas F. Siems

In the 2023 CSBS Annual Survey of Community Banks, 21% of respondents reported that their pricing decisions on loans and deposits influence local market interest rates, 59% reported they have some influence, and the remaining 20% reported no influence. Can community banks product pricing have an impact in their local markets? For banks reporting significant influence on local market rates through their product pricing decisions, as well as those reporting no influence, this question provides a unique opportunity to investigate market structure: Do community banks in smaller markets with few competitors have greater pricing power? Is there a market share threshold where product pricing influence is more significant?

To preview our results, we find that community banks located in smaller markets are more likely to report having significant product pricing power than those in more populous areas. As expected, there appears to be a general decrease in the percentage of community banks saying they have significant pricing power as market size increases. We also find that a greater percentage of smaller community banks reported having no pricing power, and that larger community banks in markets with fewer than 500,000 residents more frequently reported having significant pricing power than smaller institutions.

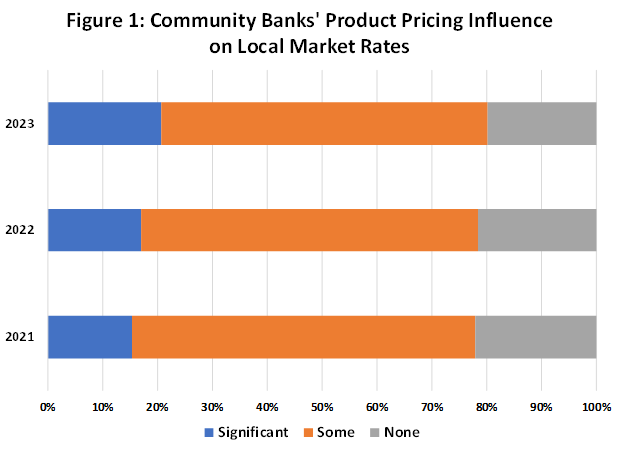

Since 2021, the CSBS Annual Survey of Community Banks has asked : “How do your bank’s pricing decisions on loans and deposits influence local market rates?” The three possible responses are: “Significantly influence local market rates” (Significant), “Have some influence on local market rates” (Some), and “Do not influence market rates” (None).

Figure 1 shows that over the past three years, the proportion of respondents reporting “Significant” product pricing power has increased by six percentage points from 15% to 21%, while the percent reporting “Some” declined from 63% to 59%, and the percent reporting “None” dropped slightly from 22% to 20%.

Does Market Size Make a Difference?

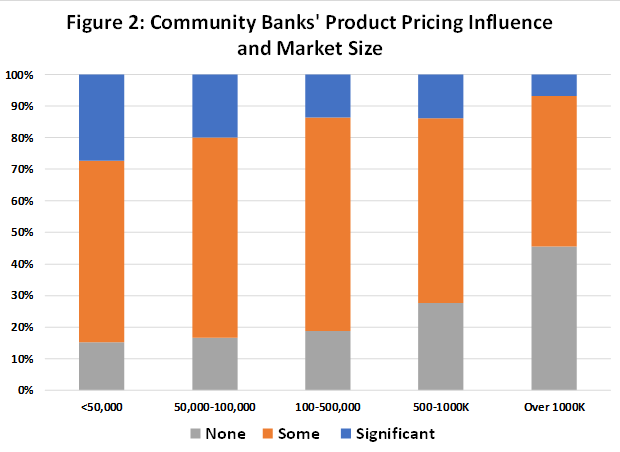

Market size should impact a bank’s ability to influence local market loan and deposit pricing if it is positively correlated with the number of competitors. Using 2022 population estimates and a bank’s headquarters location, Figure 2 shows the significant relationship between market size and the pricing power responses from the 2023 CSBS Survey. Community banks in rural areas and towns under 50,000 residents are more likely to report pricing power, and community banks in urban areas with over 1 million people are more likely to report less pricing power. This location relationship is maintained regardless of the number of branches.

Does Bank Size Make a Difference?

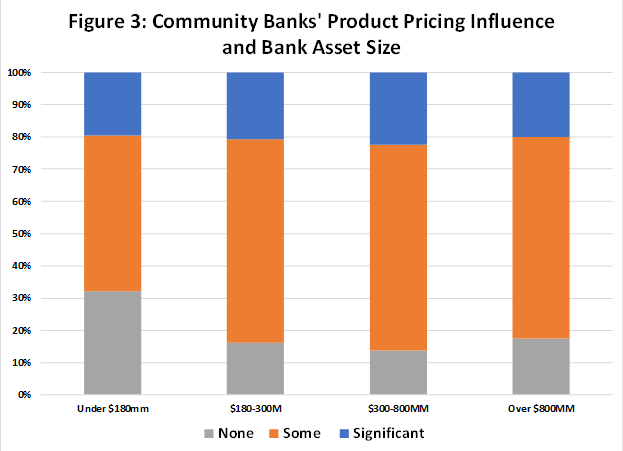

A community banks’ size seems like it would also impact their ability to influence local market pricing power, independent of market size. Larger banks with more diversified funding sources should be able to offer more attractive rates on deposits and loans.

Figure 3 shows the relationship between pricing power and community bank asset size categorized by size quartile. While the relationship is not as strong as for market size, smaller banks are more likely to report less pricing power, with roughly one-third reporting they have no influence on local market rates. Interestingly, roughly 20% of the community banks in each size quartile report having significant pricing power.

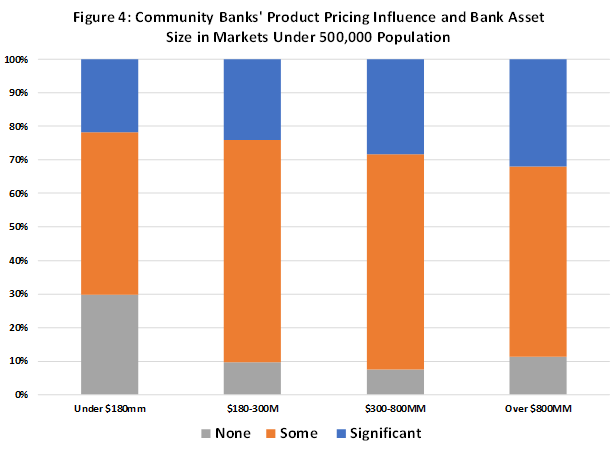

When the sample of community banks is restricted to those located in non-urban markets with populations under 500,000 people (including rural areas), this relationship is much stronger. Figure 4 shows that as a community bank grows (measured by asset size), its ability to significantly increase pricing power strengthens. A multinomial logit model confirmed these results. The number of branch offices was not significant.

Conclusion

The 2023 CSBS Annual Survey sheds light on the intriguing dynamics of pricing power within the community banking sector. With the yield curve inverted throughout 2023 and bank net interest margins squeezed by rapid interest rate movements, a bank’s pricing decisions on loans and deposits may have been the most critical aspect of its long-term strategy. Similar to CSBS Annual Surveys from previous years, 21% of community bankers say their product pricing decisions significantly influence local market interest rates, 59% say they have some influence, and the remaining 20% believe they have no influence. The distribution of responses reflects the varied economic landscapes and competitive environments that community banks operate within.

A deeper dive into the 2023 CSBS Survey confirms the predictable connection between market size and pricing power. That is, community banks situated in rural areas and smaller towns with populations under 50,000 are more likely to assert pricing power than community banks located in more populous areas. This disparity underscores the unique challenges and opportunities that community banks face based on their location.

When examining pricing power by community bank size, we find no noteworthy differences in how banks’ report significantly influencing product pricing, but a greater percentage of smaller institutions reported having no pricing power. However, when focusing only on banks in markets with fewer than 500,000 residents, larger community banks more frequently reported having significant product pricing power.

Understanding the dynamics of product pricing power is essential for community banks as they navigate the ever-changing economic and financial landscape. Smaller community banks should be mindful of their inherent limitations, although they can rely on their agility to differentiate themselves from their competitors in their local markets. In today’s complex banking and financial sector, community banks that continually assess their pricing strategies and adapt to changing challenges and opportunities will enhance their competitive edge and continue to serve their communities effectively.

2024 CSBS Annual Survey for Community Banks is Open!

The 2024 CSBS Annual Survey for Community Banks is open for community bankers. The deadline to respond is June 30. Take the survey here.

- Press Releases

Community Banks Need Tailored Rules to Thrive

Feb 5, 2025

- Blog post

Why Are Community Bankers More Optimistic?

Jan 21, 2025

- Press Releases

Community Banker Optimism Surges at End of Year

Jan 7, 2025

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts