Fed’s Discount Window Improvements Will Help Its Use

State regulators support the Federal Reserve Board of Governors’ efforts to improve the discount window’s accessibility and reduce its stigma so that it can serve as an effective and efficient source of liquidity, CSBS said in a comment letter today in response to a request for information.

The discount window is a critical source of liquidity for the banking system and serves as one of the primary means for the Federal Reserve to carry out its “lender of last resort” functions. However, its operational and technical shortcomings can be a barrier to its more frequent use, as noted in the 2024 CSBS Annual Survey of Community Banks.

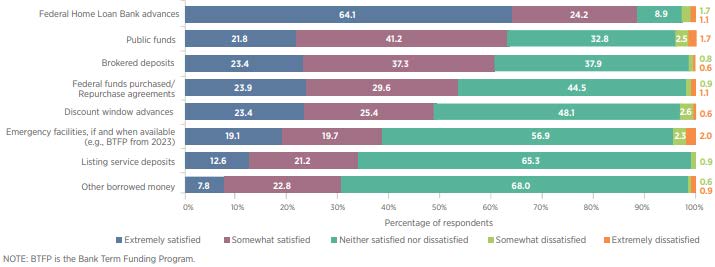

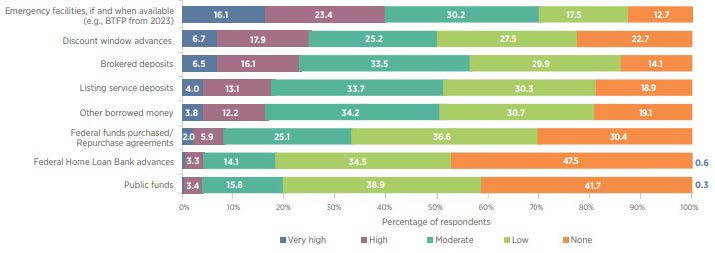

Fewer than half of the survey’s respondents said they are extremely or somewhat satisfied with discount window accessibility. By comparison, more than 88% of respondents said they are extremely or somewhat satisfied with the accessibility of the Federal Home Loan Banks, another key provider of liquidity. The discount window stigma remains a significant concern for more than half of community banks.

Additionally, future liquidity or discount window reforms could have wide ranging and significant impacts, and the federal banking agencies should consult with the Federal Housing Finance Agency and Federal Home Loan Banks on any potential changes.

Figure 1. In your experience, how satisfied are you with the accessibility of the following funding sources?

Source: 2024 CSBS Annual Survey of Community Banks

Figure 2. What level of stigma, if any, do you feel is associated with the following sources?

Source: 2024 CSBS Annual Survey of Community Banks

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter