Empowering Innovation

As the financial services industry rapidly evolves in volume and complexity, CSBS is creating data, technology, and analytical products to help state regulators anticipate and mitigate risk within the financial system.

Harnessing the Power of Data

CSBS's research and analytics services and products act as a force multiplier, giving states the information they need to accomplish more despite time and resource constraints. Whether it is helping states create risk-prioritized exam schedules, consolidating key metrics in an easy-to-read and navigate dashboard, or delving into the inner workings of the NMLS data structures, we are empowering states to create a modern and data-driven state system. We provide training, learning resources, and individualized support to help state regulators interpret data provided by the entities they regulate. We also provide data insights through blogs, academic papers, podcasts, and presentations at partner-led events, such as the American Association of Residential Mortgage Regulators Annual Conference.

Training, Certification, and Accreditation

CSBS supports the professional excellence of state financial supervision through training, professional development, certification, and accreditation. Training CSBS offers state examiners cutting-edge training for today’s fast-paced financial industry. Our in-person and online programs range from basic examiner training and continuing education to executive programs for senior department personnel. We also collaborate directly with state banking departments to develop, deliver, and manage all aspects of professional development and training programs that can be customized, held in-state or regionally, and competitively priced to keep training costs as affordable as possible.

In 2023, CSBS completed nearly 50 training and professional development programs for more than 1,500 examiners, including mortgage examiner training programs for origination and servicing examinations and for examiners-in-charge of multi-state mortgage examinations. We partnered with third parties to deliver high-quality training on cryptocurrency. In addition to in-person examiner schools, we offer many courses in a live virtual format to minimize financial and geographic barriers and to provide alternatives to traditional content delivery.

Examiner Certification Program

The CSBS Examiner Certification Program is a voluntary program designed to recognize and promote the professionalism and highly specialized skill sets of state financial regulatory agency personnel. Established more than 30 years ago and overseen by the CSBS Education Foundation’s Certification Committee, the program offers 31 different credentialing opportunities to our state regulatory members, covering bank safety and soundness, mortgage, money services businesses, trust, IT/cyber, and other specialty areas. In 2023, more than 1,150 state regulators from 47 agencies in 42 states actively participated in the program.

Accreditation

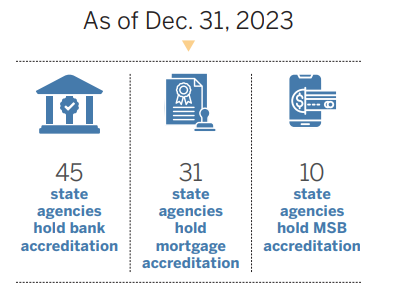

CSBS provides three accreditation programs that evaluate a state agency’s ability to meet its obligations as a bank, mortgage, and/or MSB regulator. States undergo a process of self-assessment and a review by former peer regulators to earn the accreditation every five years. The accreditation program promotes a common framework for state supervision, process standardization, and best practices.

CSBS provides three accreditation programs that evaluate a state agency’s ability to meet its obligations as a bank, mortgage, and/or MSB regulator. States undergo a process of self-assessment and a review by former peer regulators to earn the accreditation every five years. The accreditation program promotes a common framework for state supervision, process standardization, and best practices.

CSBS Data and Analytics

In 2023, more than 1,000 state regulators accessed CSBS research and analytics products in over 17,000 separate sessions across 49 states (64 state agencies for non-depository analytics). The services range from providing ad hoc data support to the development of comprehensive surveillance dashboards through the facilitation of system working groups, committees, and task forces. To maximize the value of its offerings — CSBS categorizes this work into several core functional categories:

- Financial analysis tools allow in-depth analysis of individual institutions (e.g., Depository Deep Dive) and industry or segment analytics (Call Report analysis, SES exam analytics)

- Continuous monitoring tools like RISCI and mortgage dashboards allow regulators to monitor entire portfolio performance on an ongoing basis and between exam cycles (Risk Identification for State Chartered Institutions, or RISCI, immediately flags institutions with degrading risk profiles so examiners can take proactive action)

- Training and education efforts (Virtual Day One Analytics Training, In-Person Report Design and Creation) help regulators improve skills and knowledge, supporting a data-driven approach to supervision

- Targeted local economic reporting helps regulators become experts in the markets in which their institutions operate

- Industry overviews like State At-a-Glance and the Industry Composition report help regulators understand larger trends driving performance of their individual institutions and calibrate their performance to industry benchmarks

- Research explores and evaluates data, analytical methodologies, technologies, and economic/ social dynamics that might affect supervised institutions and their regulators

- Member data tools help states manage their respective agencies and provide support with important initiatives such as resource planning

- Blog post

Supporting Our People

Jun 19, 2024

- Blog post

Strengthening Cybersecurity

Jun 12, 2024

- Blog post

State Regulation and Interagency Engagement

May 29, 2024

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter

News to your ears,

New every month.CSBS Podcasts