Request for Information and Comment on Operational Aspects of Federal Reserve Bank Extensions of Discount Window and Intraday Credit

Download the Full Comment Letter [PDF]

Ann E. Misback, Secretary

Board of Governors of the Federal Reserve System

20th Street and Constitution Avenue NW

Washington, DC 20551

Docket No. OP–1838

Re: Request for Information and Comment on Operational Aspects of Federal Reserve Bank Extensions of Discount Window and Intraday Credit

Dear Ms. Misback,

The Conference of State Bank Supervisors1 (“CSBS”) provides the following comments on the Federal Reserve Board’s (“FRB”) “Request for Information and Comment on Operational Aspects of Federal Reserve Bank Extensions of Discount Window and Intraday Credit” (“RFI”).2 The discount window is a critical source of liquidity for the banking system, and it serves as one of the primary means by which the Federal Reserve carries out its “lender of last resort” functions.

Following the March 2023 banking turmoil, regulators have encouraged banks to incorporate discount window borrowing into their contingency funding plans. For banks that do so, regulators have emphasized the supervisory expectation that these institutions be operationally prepared to access the discount window, including by establishing borrowing arrangements with a Reserve Bank, ensuring they have sufficient collateral available, familiarizing themselves with the collateral pledging process, and conducting regular discount window borrowing tests.3

- State regulators support these efforts and offer the following observations and recommendations:

- The Federal Reserve should continue to improve discount window accessibility.

- The Federal Reserve should consider targeted changes to help reduce some of the stigma associated with borrowing from the discount window.

- Liquidity and discount window issues are complex and multifaceted and should be addressed holistically through a robust, deliberative, and consultative policy process.

I. The Federal Reserve should continue to improve discount window accessibility.

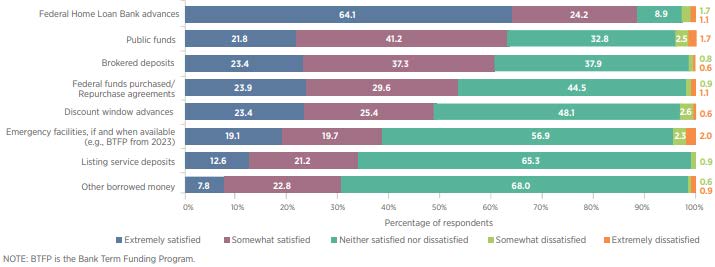

The discount window’s operational and technical shortcomings are frequently mentioned as one barrier to its more frequent use. Responses from the 2024 CSBS Annual Survey of Community Banks underscore this reality – less than half of community banks state that they are extremely or somewhat satisfied with discount window accessibility. By comparison, more than 88% of community banks are extremely or somewhat satisfied with the accessibility of the Federal Home Loan Banks (“FHLB”), another key provider of liquidity (Figure 1).4

Figure 1. In your experience, how satisfied are you with the accessibility of the following funding sources?

Enhancements to the discount window’s infrastructure and operations are critical to ensuring it can serve as an effective and efficient source of liquidity, particularly during periods of stress. State regulators support the Federal Reserve’s recent steps – and encourage additional improvements – to make the discount window more readily and easily accessible.5

CSBS also recommends that the Reserve Banks more actively coordinate and collaborate with state regulators and the 11 FHLBs. The FHLBs have recently been directed to put more emphasis on a bank’s creditworthiness rather than its collateral when making lending decisions.6 This could result in FHLBs limiting a bank’s access to FHLB credit sooner, thereby increasing demand for discount window liquidity. Among other benefits, heightened coordination between a Reserve Bank, an FHLB, and a bank’s primary regulator facilitates a consistent view of the bank’s financial condition, borrowing needs and capacity, and the adequacy and potential transfer of its collateral between an FHLB and the discount window.

II. The Federal Reserve should consider targeted changes to help reduce some of the stigma associated with borrowing from the discount window.

Stigma is a longstanding feature of discount window borrowing. Indeed, banks are unlikely to seek liquidity at a penalty rate from the “lender of last resort” except as a last resort. As such, a bank’s counterparties, competitors, regulators, and the public typically view discount window borrowing as a sign of financial distress.7

As succinctly summarized by one banker, “the day you hit [the discount window] for anything other than a test you effectively have told the world you failed.”8

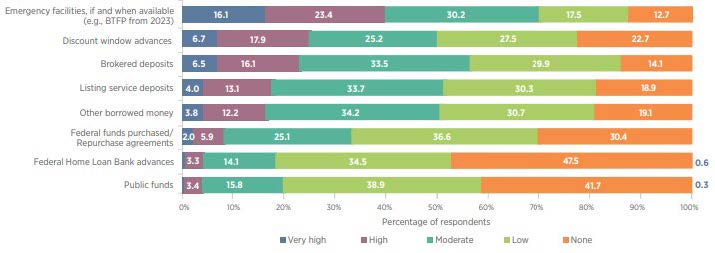

This view is reflected in CSBS survey data – more than 52% of community banks believe that borrowing from the discount window carries moderate to very high stigma. Comparatively, only 18% of community banks feel the same about borrowing from the FHLBs, with nearly half stating that FHLB advances carry no stigma (Figure 2).9

Figure 2. What level of stigma, if any, do you feel is associated with the following sources?

While this longstanding stigma is unlikely to be “eliminate[d]… through regulatory fiat,”10 the Federal Reserve should consider changes that might alleviate some of its severity. For example, changes to the Federal Reserve’s weekly balance sheet report11 could limit the release of certain information that results in stigma for discount window borrowers.12 Others have proposed regulatory and supervisory incentives that would encourage banks to be prepared to borrow from the discount window.13

III. Liquidity and discount window issues are complex and multifaceted and should be addressed holistically through a robust, deliberative, and consultative policy process.

Future liquidity or discount window reforms could have significant and wide-ranging implications on bank funding strategies (both for daily liquidity management and in times of stress), other providers of liquidity like the FHLB System, and the Federal Reserve’s other standing lending facilities, the size of its balance sheet, and monetary policy implementation. Given the potentially far-reaching impacts and range of views within and outside of the federal banking agencies (“FBAs”), CSBS requests that the FBAs work together to explore the design of any liquidity or discount window reforms. Moreover, the FBAs should seek to avoid disrupting the critical and unique role of FHLB liquidity in the banking system. Therefore, state regulators recommend that the FBAs also consult the FHLB System and its regulator, the Federal Housing Finance Agency (“FHFA”), as part of any rulemaking effort.

Conclusion

CSBS recommends that the FRB continue efforts to improve the discount window’s accessibility and reduce its stigma so that it can serve as an effective and efficient source of liquidity. State regulators also request that the FBAs consult with the FHLB System and FHFA regarding any future liquidity or discount window reforms.

Sincerely,

Brandon Milhorn

President and CEO

Endnotes

1 CSBS is the nationwide organization of state banking and financial regulators from all 50 states, the District of Columbia, and the U.S. territories.

2 FRB, Request for Information and Comment, Request for Information and Comment on Operational Aspects of Federal Reserve Bank Extensions of Discount Window and Intraday Credit, 89 Fed. Reg. 73415 (Sept. 10, 2024).

3 See, e.g., OCC, FRB, FDIC, AND NCUA, Addendum to the Interagency Policy Statement on Funding and Liquidity Risk Management: Importance of Contingency Funding Plans (July 28, 2023).

4 CSBS, 2024 CSBS Annual Survey of Community Banks, Presented at the 12th Annual Community Banking Research Conference (Oct. 2-3, 2024).

5 For example, in January 2024, the Federal Reserve launched Discount Window Direct, a new self-service application that allows banks to access the discount window through an online portal. FRB Governor Michelle Bowman has proposed other discount window improvements. See e.g., Liquidity, Supervision, and Regulatory Reform (July 18, 2024).

6 FHFA, Advisory Bulletin, AB 2024-03: FHLBank Member Credit Risk Management (Sept. 27, 2024).

7 See e.g., Mark Carlson and Johnathan D. Rose, "Stigma and the Discount Window," FEDS Notes, Board of Governors of the Federal Reserve System (Dec. 19, 2017); see also Olivier Armantier, Marco Cipriani, and Asani Sarkar, "Discount Window Stigma After the Global Financial Crisis," Federal Reserve Bank of New York Staff Reports, no. 1137 (Nov. 2024).

8 William Demchak, "One Year Later: Lessons Learned from the March 2023 Bank Failures," Brookings Institution, at 28:22 (Mar. 5, 2024), available at: https://youtu.be/r9nTijyjQV8

9 Supra note 4.

10 FRB Governor Michelle Bowman, Bank Liquidity, Regulation, and the Fed's Role as Lender of Last Resort, The Roundtable on the Lender of Last Resort: The 2023 Banking Crisis and COVID, Committee on Capital Markets Regulation, Washington, DC (Apr. 3, 2024).

11 See Federal Reserve Balance Sheet: Factors Affecting Reserve Balances - H.4.1.

12 Current reporting of regional Reserve Bank balance sheets on the weekly H.4.1 statistical release makes it easy to deduce which banks, particularly larger institutions, are borrowing from the discount window in near real-time. The Federal Reserve could further aggregate the H.4.1 to remove individual Reserve Bank balance sheets while still disclosing systemwide information to the public. See Steven Kelly, "Weekly Fed Report Still Drives Discount Window Stigma," Yale Program on Financial Stability (Apr. 3, 2024).

13 For example, discount window borrowing could be incorporated into liquidity coverage ratio or internal liquidity stress tests. See, e.g., Bill Nelson, Testimony, Lender of Last Resort: Issues with the Fed Discount Window and Emergency Lending, U.S. House Financial Services Subcommittee on Financial Institutions and Monetary Policy (Feb. 15, 2024).

Get Updates

Subscribe to CSBS

Stay up to date with the CSBS newsletter